The Basic Principles Of Clark Wealth Partners

Some Known Facts About Clark Wealth Partners.

Table of ContentsThe Definitive Guide to Clark Wealth PartnersThe Buzz on Clark Wealth PartnersThe Only Guide to Clark Wealth PartnersThe 7-Second Trick For Clark Wealth PartnersThe 5-Minute Rule for Clark Wealth PartnersThings about Clark Wealth PartnersThe Definitive Guide for Clark Wealth Partners

The globe of money is a challenging one. The FINRA Foundation's National Capacity Research Study, for example, lately located that nearly two-thirds of Americans were incapable to pass a standard, five-question financial literacy test that quizzed participants on topics such as interest, debt, and various other reasonably fundamental concepts. It's little marvel, then, that we usually see headings lamenting the bad state of most Americans' financial resources (financial planner scott afb il).Along with handling their existing clients, monetary consultants will certainly commonly invest a fair quantity of time weekly meeting with prospective clients and marketing their solutions to maintain and grow their company. For those taking into consideration becoming an economic consultant, it is essential to take into consideration the average income and job security for those functioning in the area.

Courses in tax obligations, estate planning, investments, and threat administration can be valuable for students on this course. Depending on your distinct job objectives, you might likewise require to make certain licenses to fulfill specific clients' demands, such as getting and selling stocks, bonds, and insurance coverage. It can additionally be helpful to make a certification such as a Certified Financial Coordinator (CFP), Chartered Financial Analyst (CFA), or Personal Financial Professional (PFS).

Not known Factual Statements About Clark Wealth Partners

What that looks like can be a number of things, and can vary depending on your age and phase of life. Some people stress that they require a specific amount of cash to spend before they can obtain assist from a professional (financial advisors Ofallon illinois).

All About Clark Wealth Partners

If you have not had any kind of experience with an economic advisor, right here's what to expect: They'll begin by supplying a comprehensive analysis of where you stand with your assets, obligations and whether you're meeting criteria contrasted to your peers for savings and retired life. They'll review short- and long-lasting goals. What's handy regarding this action is that it is individualized for you.

You're young and working full-time, have a cars and truck or 2 and there are trainee car loans to repay. Below are some possible concepts to help: Develop excellent savings practices, pay off financial debt, established baseline goals. Pay off student fundings. Depending upon your profession, you may qualify to have part of your school car loan waived.

Clark Wealth Partners - An Overview

You can review the following ideal time for follow-up. Before you start, ask about prices. Financial experts usually have various rates of rates. Some have minimal asset degrees and will bill a fee normally numerous thousand dollars for producing and readjusting a plan, or they may charge a flat charge.

Always review the small print, and see to it your economic expert complies with fiduciary requirements. You're looking ahead to your retirement and aiding your kids with greater education and learning costs. A monetary consultant can supply advice for those situations and more. A lot of retirement strategies provide a set-it, forget-it alternative that allots properties based upon your life phase.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Set up normal check-ins with your organizer to fine-tune your plan as needed. Balancing cost savings for retirement and university prices for your kids can be challenging.

Considering when you can retire and what post-retirement years might look like can create concerns about whether your retirement financial savings remain in line with your post-work strategies, or if you have actually conserved enough to leave a tradition. Assist your monetary expert understand your technique to cash. If you are extra traditional with saving (and prospective loss), their suggestions need to react to your fears and worries.

Clark Wealth Partners for Beginners

For instance, preparing for healthcare is one of the huge unknowns in retired life, and an economic professional can outline options and suggest whether additional insurance policy as security might be valuable. Before you begin, attempt to get comfy with the idea of sharing your entire economic picture with a specialist.

Offering your specialist a complete image can help them create a strategy that's focused on to all components of your financial condition, especially as you're quick approaching your post-work years. If your financial resources are basic and you have a love for doing it on your own, you may be fine on your own.

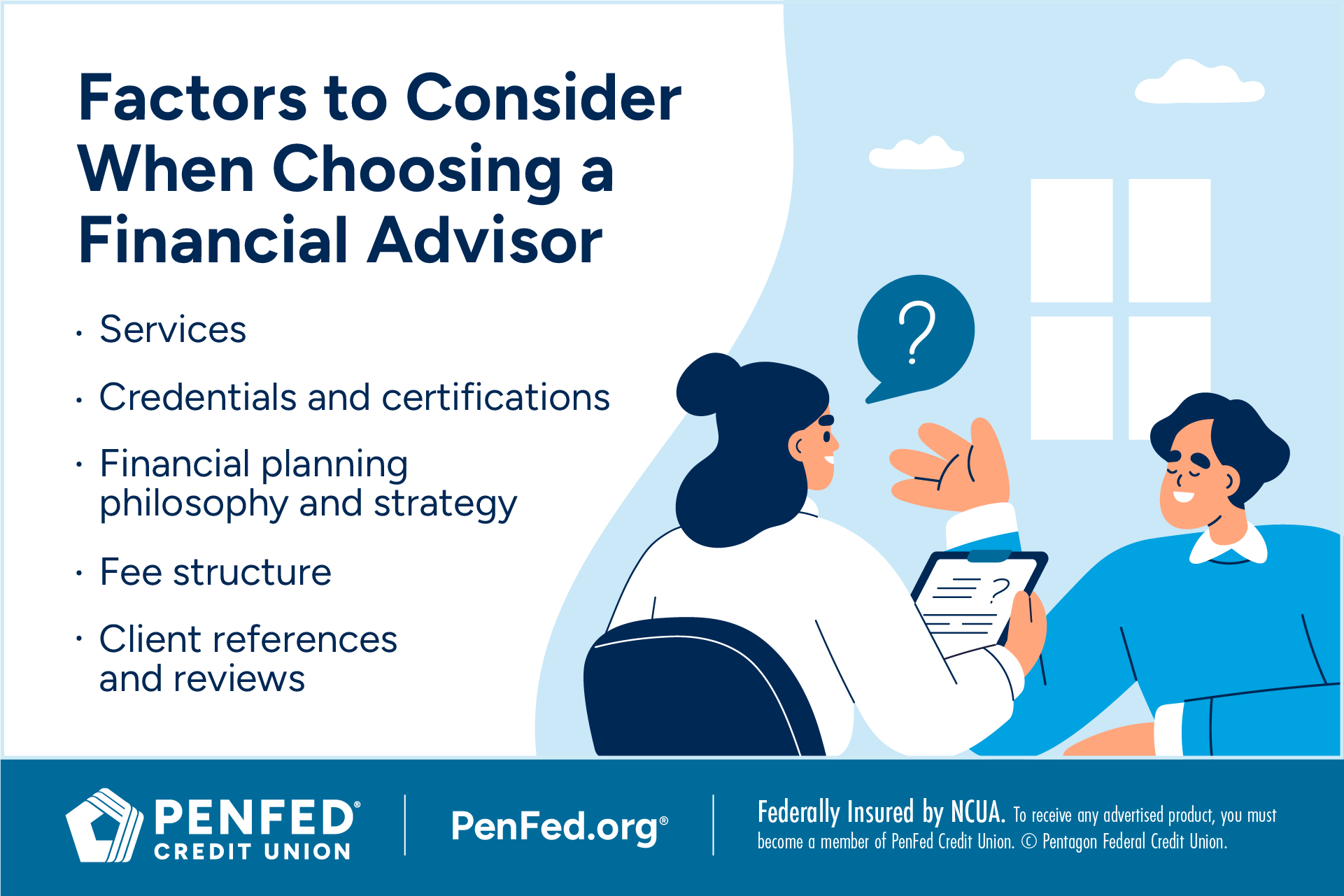

A monetary consultant is not only for the super-rich; anybody encountering significant life shifts, nearing retirement, or sensation bewildered by monetary choices might take advantage of expert support. This short article checks out the duty of financial advisors, when you might need to get in touch with one, and key considerations for picking Learn More - https://www.kickstarter.com/profile/1328396888/about. An economic consultant is a qualified expert that helps customers manage their funds and make educated choices that line up with their life goals

The 7-Minute Rule for Clark Wealth Partners

In comparison, commission-based experts gain earnings through the monetary items they sell, which might affect their referrals. Whether it is marital relationship, separation, the birth of a child, occupation modifications, or the loss of an enjoyed one, these events have unique monetary ramifications, frequently calling for timely choices that can have long-term effects.